The Growth of Decentralized Exchanges (DEXs) in the DeFi Ecosystem

- The Rise of DEXs in DeFi

- Exploring the Popularity of Decentralized Exchanges

- The Evolution of Decentralized Trading Platforms

- Challenges and Opportunities for DEXs in DeFi

- The Role of DEXs in the Cryptocurrency Ecosystem

- Regulatory Considerations for Decentralized Exchanges

The Rise of DEXs in DeFi

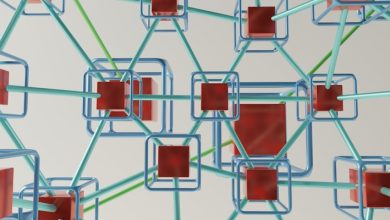

Decentralized exchanges (DEXs) have seen a significant rise in popularity within the decentralized finance (DeFi) ecosystem. These platforms allow users to trade cryptocurrencies directly from their wallets, without the need for a central authority. The growth of DEXs in DeFi has been fueled by the desire for increased privacy, security, and control over assets. As a result, many users are turning to DEXs as a preferred method for trading digital assets.

Exploring the Popularity of Decentralized Exchanges

The popularity of Decentralized Exchanges (DEXs) has been steadily growing within the DeFi ecosystem. This surge in interest can be attributed to several factors that have contributed to the rise of DEXs as a preferred platform for trading cryptocurrencies.

One key reason for the increasing popularity of DEXs is the emphasis on security and privacy. DEXs operate on a decentralized network, which means that users have full control over their funds and transactions without the need to trust a central authority. This level of security is appealing to many individuals who are wary of traditional centralized exchanges.

Furthermore, DEXs offer a wide range of trading pairs, allowing users to easily exchange one cryptocurrency for another without the need for a third party. This flexibility and convenience have attracted traders looking to diversify their portfolios and take advantage of new investment opportunities.

Another factor driving the popularity of DEXs is the growing interest in decentralized finance (DeFi) applications. DEXs play a crucial role in the DeFi ecosystem by providing liquidity for various decentralized applications and enabling seamless peer-to-peer transactions.

In conclusion, the rise of Decentralized Exchanges (DEXs) can be attributed to their focus on security, privacy, flexibility, and their integral role in the DeFi ecosystem. As more users become aware of the benefits of DEXs, their popularity is expected to continue growing in the future.

The Evolution of Decentralized Trading Platforms

Decentralized trading platforms have undergone a significant evolution in recent years within the DeFi ecosystem. These platforms have played a crucial role in enabling users to trade cryptocurrencies without the need for a central authority or intermediary. The growth of DEXs has been driven by the increasing demand for more secure and transparent trading options in the crypto space.

One of the key features that have contributed to the evolution of decentralized trading platforms is the use of smart contracts. Smart contracts allow for the execution of trades automatically based on predefined conditions, eliminating the need for a third party to facilitate transactions. This has helped to streamline the trading process and reduce the risk of human error or manipulation.

Another significant development in the evolution of DEXs is the integration of liquidity pools. Liquidity pools enable users to trade assets directly with each other, rather than through an order book. This has led to increased liquidity and reduced slippage in trades, making decentralized trading platforms more efficient and cost-effective for users.

Furthermore, the emergence of cross-chain compatibility has further enhanced the functionality of decentralized trading platforms. By allowing users to trade assets across different blockchains, DEXs have become more versatile and accessible to a wider range of users. This interoperability has opened up new opportunities for decentralized trading and has contributed to the overall growth of the DeFi ecosystem.

Challenges and Opportunities for DEXs in DeFi

Decentralized Exchanges (DEXs) in the DeFi ecosystem face a range of challenges and opportunities as they continue to grow and evolve. These platforms offer a new way for users to trade digital assets without the need for a centralized intermediary, providing increased privacy, security, and control over their funds.

One of the main challenges for DEXs is liquidity. Unlike centralized exchanges, which often have large order books and high trading volumes, DEXs can struggle to attract enough liquidity to ensure smooth and efficient trading. This can result in slippage and higher transaction costs for users, making it less attractive for traders to use these platforms.

Another challenge for DEXs is user experience. Many decentralized exchanges can be difficult to use, especially for newcomers to the space. Improving the user interface and overall user experience is crucial for attracting a wider audience and increasing adoption of DEXs in the DeFi ecosystem.

Despite these challenges, DEXs also present a number of opportunities for growth and innovation. One of the main advantages of DEXs is their resilience to censorship and government interference. By operating on a decentralized network, DEXs are able to provide users with greater financial freedom and autonomy over their assets.

Additionally, DEXs offer the potential for new financial products and services to be built on top of their platforms. By leveraging smart contracts and other blockchain technologies, developers can create decentralized lending, borrowing, and trading protocols that can revolutionize the traditional financial system.

The Role of DEXs in the Cryptocurrency Ecosystem

In the cryptocurrency ecosystem, decentralized exchanges (DEXs) play a crucial role in enabling peer-to-peer trading without the need for a central authority. DEXs provide users with a platform to trade cryptocurrencies directly with each other, eliminating the need for intermediaries and reducing the risk of hacking or fraud.

One of the key advantages of DEXs is the enhanced security they offer. By allowing users to retain control of their funds and trade directly from their wallets, DEXs minimize the risk of funds being lost or stolen. This added layer of security has made DEXs increasingly popular among traders who prioritize security and privacy.

Additionally, DEXs contribute to the overall decentralization of the cryptocurrency ecosystem. By enabling direct peer-to-peer trading, DEXs help reduce reliance on centralized exchanges, which can be vulnerable to regulatory crackdowns or operational issues. This decentralization is in line with the ethos of cryptocurrency, which aims to create a more democratic and transparent financial system.

Regulatory Considerations for Decentralized Exchanges

When considering the growth of decentralized exchanges (DEXs) in the DeFi ecosystem, it is crucial to also examine the regulatory considerations that come into play. While DEXs offer a more secure and private way to trade cryptocurrencies compared to centralized exchanges, they are not exempt from regulatory scrutiny. In fact, regulators around the world are increasingly focusing on DEXs to ensure compliance with anti-money laundering (AML) and know your customer (KYC) regulations.

One of the main challenges for DEXs is how to balance the decentralized nature of their platforms with the need to adhere to regulatory requirements. While DEXs pride themselves on being trustless and permissionless, regulators are concerned about the potential for illicit activities such as money laundering and terrorist financing. As a result, DEXs need to find ways to implement AML and KYC measures without compromising the privacy and security of their users.

Some DEXs have started to implement solutions such as decentralized identity verification and transaction monitoring tools to meet regulatory requirements while still maintaining the core principles of decentralization. By leveraging blockchain technology, DEXs can create more transparent and auditable processes that allow regulators to monitor transactions without compromising user privacy.